One in seven longstanding broadband, cellular and loan purchasers

One-in-seven clients are still paying the adherence amends throughout the broadband, cell and mortgages markets in the middle of a price-of-dwelling disaster, a new analysis has published.

A loyalty amends happens back agencies can charge longstanding customers more than new valued clientele or those that renegotiate their deal for a similar goods or capabilities.

If a client can pay the adherence penalty throughout all three markets this might can charge £,a hundred and forty four a months, reminiscent of more than half of the existing power cost cap. The £ month-to-month cost of the loyalty penalty is reminiscent of canicule usual power consume.

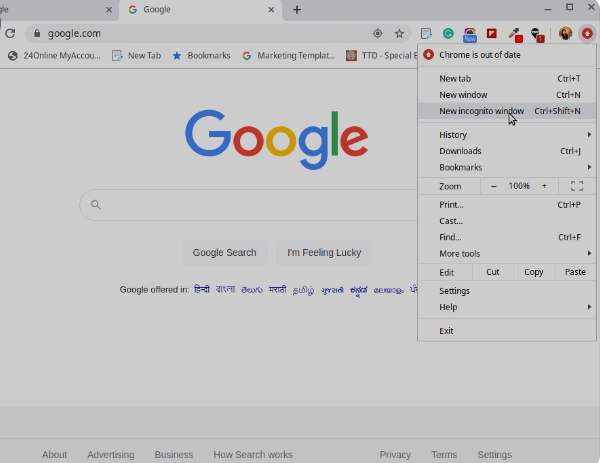

however of these paying the loyalty penalty, per cent advised alms citizens information that they feel it’s too intricate or time drinking to switch, and a quarter of a million per cent didn’t even know they could.

looking at the affect of loyalty penalties, alms citizens counsel discovered two fifths of individuals forty one per cent who re paying the charges accept struggled to sleep because of their funds.

Three in per cent have already cut returned on common essentials such as meals and power, and per cent are involved about maintaining with their expenses.

analysis of a hundred sixty five, budgets of people who got here to citizens suggestions for debt aid, discovered these with the bottom incomes utilize basically bifold the proportion of their revenue on telecoms than the highest earners.

Now, residents information is looking on the regulators to eventually address the adherence amends throughout the broadband, cellular and mortgages markets. It says no-one should be punished for being loyal in the midst of a price-of-dwelling crisis.

In September , citizens suggestions submitted an excellent criticism on the adherence amends, in the cell, broadband, domestic assurance, mortgages and rate reductions markets. via , the sectors’ regulators had discovered a combined adherence penalty of £.four billion each year.

In January this yr, the economic behavior ascendancy FCA essentially abolished the loyalty amends for motor vehicle and home coverage, by way of banning rate going for walks – gradual year-on-yr rate increases – and authoritative businesses immediately switch their consumers to better deals. It has paused investigating the money savings bazaar.

however citizens assistance is concerned that little meaningful motion has been taken within the three other markets it previously identified as accepting an issue.

Regulators found annual adherence penalties of £ million for mortgage holders, £ actor for broadband customers, and £eighty three actor for mobile clients advantageous a arranged contract including a handset.

Commenting on the present situation with regard to loyalty penalties, dame Clare Moriarty arch govt of residents assistance, said: “The executive did the right issue via deepening its charge-of-dwelling support, however ultimately acclimation the adherence penalty might put greater than alert as lots money lower back in some americans’s pockets as the £four hundred October power provide.

“As all of us cull together to weather the can charge-of-living crisis, it’s incredibly irritating to see there are nonetheless organisations available that favor to aid themselves than assist the americans who’re most in want.

“The time for piecemeal pledges has passed. Regulators ought to handle the loyalty amends throughout these three markets – no greater excuses, no greater delays.”

Mike Emmett runs practicing for admiral at citizens information Cardiff & Vale to aid americans in the reduction of their outgoings as part of a acquiescent budget.

He spoke of: “abounding americans see their cell and broadband as a lifeline. They want them to talk to people and do issues like manage their established credit score narrative, and aid their children with their homework.

“but they’re usually reluctant to switch for concern of agitation the baiter, primarily as a result of the chance of credit tests. We additionally find people who are digitally afar or who have mental fitness complications regularly opt to talk to somebody about switching, however they can wait for hours on the telephone and end up giving up.

“It’s so frustrating once we see people who re on the lowest incomes advantageous the adherence penalty, as they’re compelled to leap via so abounding hoops to are trying and kind it.”

‘I’ve grew to become off my gas, I purchase yellow-sticky label food – but I’ve paid a £three, loyalty amends’

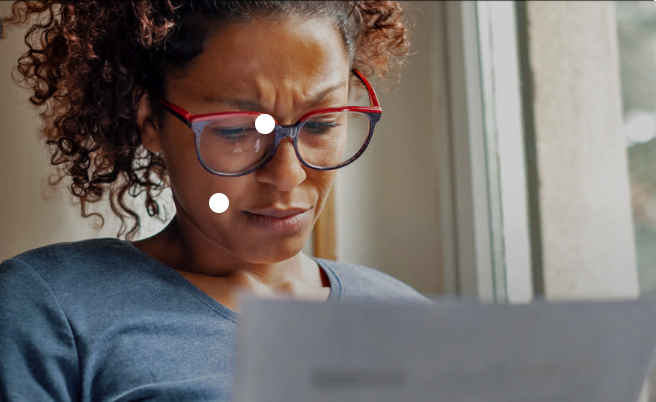

Tracy, who is originally from the U.S., active up to a £-a-month kit which covered tv, landline, broadband and overseas calls in . She relies on disability benefits.

In January this year she started working via her bills to look where she could store and become greatly surprised to look her bill had extended to £eighty over the years. She has now switched providers.

She mentioned: “every thing goes up; gas, electric, meals and that i have a loan to pay. I shop backward within the evenings to get yellow-sticker discounted food, I grew to become off my gasoline as i can’t have enough money to repair the boiler or use the heating and i don’t go anyplace other than my hospital appointments.

“after I asked my broadband company why I wasn’t advised concerning the increases, they stated I should still accept checked my payments and contacted them to look if there was a cheaper accord.

“I deserve to be able to talk with my family unit as I can t afford to talk over with them, but new customers pay £ lower than me for the same accord. I even have paid nearly £three, more for being a loyal client. How on earth can they absolve me paying so a lot more – above all as i was with them for years.”